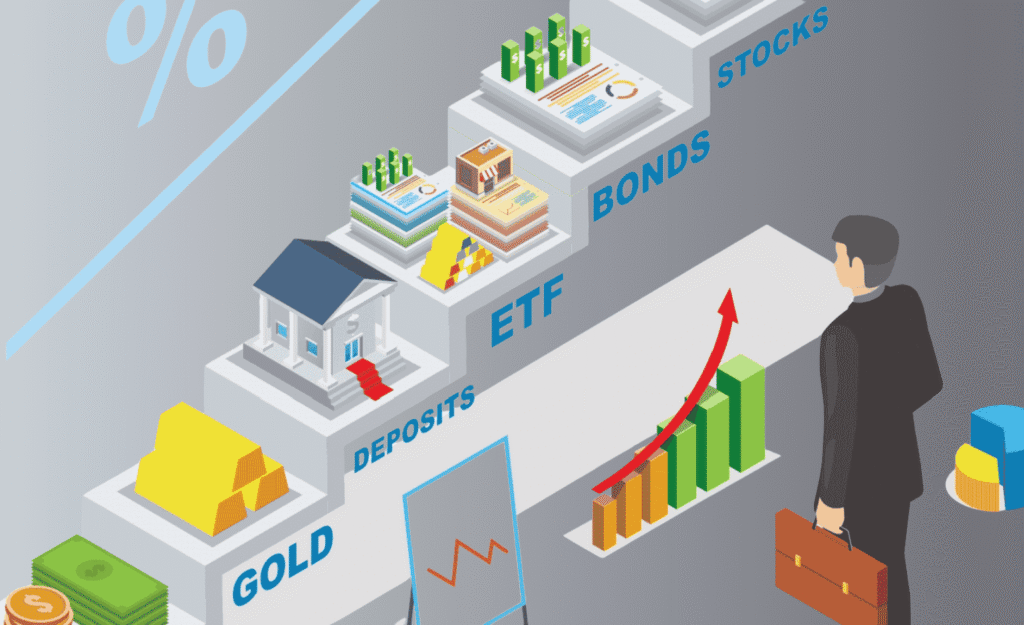

Investing wisely in 2025 requires more than just tracking good timing. It demands a clear understanding of shifting market dynamics, risk tolerance, and personal financial goals. With inflation trends, global tech expansion, and sustainability gaining momentum, choosing the right investment options has become essential.

Whether you’re building your first portfolio or refining a seasoned one, aligning your investment approach with evolving economic conditions is essential. Let’s break down today’s most reliable and emerging investment options, offering insights tailored for different risk levels, income groups, and life stages.

Let’s start with a quick overview of the investment climate in 2025.

An Overview of the Current Market

The investment landscape in 2025 is shaped by a mix of economic resilience and cautious optimism. Global markets have shown moderate recovery post-pandemic, but rising interest rates and inflationary pressures continue to influence investor sentiment. According to the International Monetary Fund (IMF), global GDP is expected to grow at a modest 2.9%, with stronger performance seen in emerging markets.

Major stock indices like the S&P 500 and NASDAQ have experienced volatility due to tech sector corrections, while sectors like energy, defense, and healthcare are showing stability. Meanwhile, central banks across the globe maintain a tight monetary policy, signaling a more conservative approach from governments toward spending and debt.

For everyday investors, this means keeping an eye on both domestic trends and international signals is more important than ever. Diversification, risk assessment, and long-term vision are key in navigating this nuanced financial environment.

Trending Investment Options for 2025

Investors in 2025 face a landscape shaped by rising interest rates, new technologies, and a growing focus on sustainability. Below are detailed insights into the top investment options this year, including key data and considerations.

High-Yield Savings Accounts

High-yield savings accounts have become particularly attractive due to higher interest rates, often offering annual yields of 4% to 5%. These accounts, usually from online banks, are FDIC-insured, meaning deposits up to $250,000 are protected.

They are perfect for parking cash needed in the short term or as emergency funds. Unlike many investments, these accounts carry no market risk, offering a rare opportunity for a risk-free real return that currently outpaces inflation, which is currently hovering around 3% in 2025. Keep in mind that interest earned is taxable as ordinary income unless held in tax-advantaged accounts.

Certificates of Deposit (CDs) and CD Ladders

CDs lock your money in for a fixed term, such as 1, 3, or 5 years, in exchange for guaranteed interest rates. In 2025, 1-year CDs often yield above 5%, with longer terms paying even more.

Unlike savings accounts, these rates won’t fluctuate if market interest rates fall. Early withdrawal penalties apply, so CDs suit funds you won’t need soon. To balance access and yield, many investors use a CD ladder, which involves splitting funds into CDs with staggered maturities (e.g., 1 to 5 years).

This method provides periodic access to cash while locking in attractive, longer-term rates. CDs are FDIC-insured, offering safety but limited liquidity.

Government Bonds and Treasury Securities

U.S. Treasury securities, which include short-term bills, intermediate notes, and long-term bonds, remain a solid choice for risk-averse investors.

In 2025, yields on these instruments range between 4% and 5%, reaching levels not seen in over a decade due to recent rate hikes. Treasury Inflation-Protected Securities (TIPS) offer inflation-adjusted returns, protecting purchasing power amid rising prices.

These bonds are backed by the full faith and credit of the U.S. government, virtually eliminating default risk. They provide steady income, making them popular with retirees or those seeking capital preservation. While bond prices can fluctuate inversely with interest rates, holding to maturity guarantees face value repayment.

Stable Value Funds

Stable value funds, found mostly in employer-sponsored retirement plans like 401(k)s, offer bond-like yields with minimal volatility. They invest in a mix of fixed-income assets but use insurance contracts to smooth returns and protect principal.

In 2025, these funds are yielding around 4% to 5%, roughly double what money market funds pay but with less price fluctuation than typical bond funds.

They serve conservative investors, especially those nearing retirement, who want predictable returns without risking principal. Unlike bank accounts, these funds aren’t FDIC-insured but have a strong track record of capital preservation.

Dividend-Paying Stocks

Stocks that regularly pay dividends provide investors with income and growth potential. Dividend yields vary but often range from 2% to over 5%, especially in sectors like utilities, real estate, and consumer staples.

These companies tend to be mature, financially stable, and less volatile than growth stocks. Dividend growth stocks, which consistently increase payouts, are popular among younger investors seeking to build income over time.

Dividends in taxable accounts are usually taxed annually, often at favorable qualified dividend rates. Dividend stocks balance steady income with capital appreciation, making them a defensive choice in uncertain markets.

Corporate Bonds (Investment-Grade and High-Yield)

Corporate bonds are debt securities issued by companies. Investment-grade bonds from financially strong firms yield about 5%, while high-yield (junk) bonds can offer 7% to 10% or more to compensate for higher default risk.

High-yield bonds behave somewhat like stocks, with prices sensitive to economic downturns. As individual bonds carry issuer-specific risk, diversifying through bond funds or ETFs is advisable.

Corporate bond interest is taxed as ordinary income. These bonds suit investors seeking higher income than Treasurys but who can tolerate some credit risk.

Real Estate Investment Trusts (REITs)

REITs enable investors to own shares in real estate portfolios, providing liquidity and income without requiring direct property management. They typically pay dividends between 4% and 6%, and are required by law to distribute about 90% of taxable income.

Rising interest rates challenged some REIT sectors in 2022–2023, but industrial, residential, and data center REITs showed resilience. REITs can diversify portfolios because real estate often moves differently from stocks or bonds. Investors should monitor interest rates since higher rates can pressure highly leveraged REITs.

Target-Date Funds

Target-date funds simplify retirement investing by automatically adjusting asset allocation as the investor approaches a chosen retirement year. Early on, portfolios are typically stock-heavy for growth, then shift to a balance of bonds and cash for stability.

These funds offer diversification and automatic rebalancing, with fees generally low at large providers. In 2025, they provide peace of mind amid market volatility by gradually reducing risk exposure. Choosing a fund close to your expected retirement year and maintaining contributions is key.

Artificial Intelligence (AI) and Technology Stocks

The AI boom continues to drive explosive growth in tech stocks, with companies like NVIDIA seeing multi-hundred percent gains over recent years. AI and related sectors such as cloud computing and cybersecurity are poised for long-term growth but remain highly volatile. Tech stocks often carry high valuations based on future growth potential, meaning sharp price swings are common. Investors are advised to diversify within tech-focused ETFs or limit individual stock exposure to manage risk.

Green Energy and Sustainable Investment Options

Investment in clean energy and sustainability is rapidly growing, fueled by global climate goals and policy support. In 2025, global clean energy investments are projected to exceed $2 trillion, with solar alone reaching $450 billion.

Options include renewable energy companies, green bonds, ESG funds, and clean tech startups. While growth prospects are strong, risks include regulatory changes and competition. Sustainable investments offer financial returns aligned with environmental values and long-term secular trends.

Cryptocurrency and Blockchain Technologies

Cryptocurrency remains highly speculative but has gained institutional interest. Bitcoin and Ethereum lead the market, offering potential for high returns and portfolio diversification due to low correlation with traditional assets. However, crypto is extremely volatile, with 50% price swings common, and faces regulatory uncertainty.

Experts generally recommend limiting crypto exposure to 1–5% of a portfolio and using secure storage methods. Blockchain technology’s expanding applications offer additional investment avenues beyond coins.

Peer-to-Peer (P2P) Lending

P2P lending allows investors to lend directly to individuals or small businesses via online platforms, earning interest rates of 5–10% annually. While returns beat many traditional fixed-income investments, P2P loans are unsecured and illiquid, with default risks higher than bank products.

Diversifying across many small loans helps manage risk. P2P suits investors seeking higher income who can tolerate credit risk and long-term capital commitment, typically 3 to 5 years.

Impact of Inflation on Investment Options

Inflation remains a critical factor influencing the performance of investments in 2025. As prices rise, the real value of returns can diminish, making it essential to choose assets that either keep pace with or outgrow inflation.

Traditional savings accounts and some bonds may struggle to beat inflation, leading investors to seek inflation-protected securities like TIPS or assets tied to real-world goods such as real estate. Stocks, especially those of companies with pricing power, often provide a hedge by increasing dividends and earnings over time.

Similarly, commodities and certain sectors like energy and materials historically benefit during inflationary periods. Understanding the impact of inflation helps investors strike a balance between growth and protection, ensuring their portfolios maintain purchasing power across economic cycles.

Comparative Analysis of Investment Options

Choosing the right investment platform is just as important as selecting the right assets. In 2025, investors can choose from traditional brokerage firms, robo-advisors, mobile trading apps, and peer-to-peer lending platforms.

Each offers distinct features, fee structures, and investment options suited to different goals and experience levels. Here’s a quick comparison to help you decide which platform aligns best with your needs:

| Platform Type | Fees | Best For | Investment Options | Ease of Use | Personal Advice |

|---|---|---|---|---|---|

| Traditional Brokers | Moderate to High | Experienced investors | Stocks, bonds, funds, options | Advanced tools | Personalized advisory |

| Robo-Advisors | Low to Moderate | Beginners & hands-off | ETFs, index funds | Simple, automated | Algorithm-based |

| Mobile Trading Apps | Low to No fees | Active traders & millennials | Stocks, crypto, fractional shares | Very user-friendly | Limited |

| P2P Lending Platforms | Variable | Alternative income seekers | Personal/business loans | Platform dependent | Minimal |

These differences ensure your platform supports your investment style, whether you prefer hands-on control, automation, or alternative income streams.

Long-term vs. Short-term Investment Options

Choosing between long-term and short-term investments depends on your financial goals and liquidity needs. Long-term options typically offer higher returns but require more patience and tolerance for market fluctuations.

Short-term investments prioritize safety and quick access to funds but usually come with lower returns. Understanding their differences helps you build a portfolio that strikes a balance between growth and security.

Long-term investments can include stocks, real estate, and retirement accounts, while short-term options cover savings accounts, CDs, and money market funds. Striking the right balance ensures your money is working efficiently toward your priorities.

| Investment Type | Typical Duration | Risk Level | Return Potential | Liquidity | Best For |

|---|---|---|---|---|---|

| Long-term | 5+ years | Moderate to High | Higher | Low | Retirement, wealth growth |

| Short-term | Less than 3 years | Low | Lower | High | Emergency fund, short goals |

Risk Assessment in All Investment Options

Every investment carries some level of risk, and understanding these risks is essential for making informed decisions. Risk varies based on market volatility, economic factors, and the nature of the investment itself.

While stocks and cryptocurrencies offer high return potential, they come with significant price fluctuations. Conversely, government bonds and savings accounts offer stability but typically yield` lower returns. Assessing risk in relation to your financial goals and tolerance helps avoid unpleasant surprises and aligns your portfolio with your comfort level.

| Investment Option | Risk Level | Volatility | Potential Returns | Suitability |

|---|---|---|---|---|

| High-Yield Savings Accounts | Low | Very Low | Low | Conservative investors |

| Certificates of Deposit (CDs) | Low | Very Low | Low to Moderate | Risk-averse, short-term goals |

| Government Bonds & Treasuries | Low | Low | Moderate | Capital preservation |

| Dividend-Paying Stocks | Moderate | Moderate | Moderate to High | Income seekers, moderate risk |

| Corporate Bonds | Moderate to High | Moderate | Moderate to High | Risk-tolerant investors |

| Real Estate Investment Trusts | Moderate | Moderate | Moderate | Diversification seekers |

| AI and Tech Stocks | High | High | High | Aggressive investors |

| Cryptocurrency | Very High | Very High | Very High | Speculative, high risk tolerance |

Balancing risk and reward is key. Diversifying investments across various risk levels can help smooth returns and protect your capital.

Tax Implications of Different Investment Options

Taxes can significantly affect your investment returns, so understanding how different options are taxed helps optimize your strategy. Interest income from savings accounts and bonds is generally taxed as ordinary income.

Dividends and long-term capital gains from stocks often benefit from lower tax rates. Certain retirement accounts offer tax deferral or exemptions, boosting growth potential.

Cryptocurrency taxation varies by jurisdiction, but it usually treats gains as capital gains. Planning investments with tax efficiency in mind allows more money to work for you.

| Investment Option | Tax Treatment | Tax Rate Examples | Tax-Advantaged Accounts | Notes |

|---|---|---|---|---|

| High-Yield Savings Accounts | Interest taxed as ordinary | Up to 37% (US federal rate) | Not applicable | Taxable annually |

| Certificates of Deposit (CDs) | Interest taxed as ordinary | Up to 37% | IRAs can hold CDs | Early withdrawal penalties |

| Government Bonds & Treasuries | Interest taxed as ordinary | Varies by state/federal | Dividends are taxed as ordinary | Tax-exempt options available |

| Dividend-Paying Stocks | Non-qualified dividends are taxed as ordinary income | 0-20% (long-term capital gains rates) | Tax-advantaged accounts preferred | Some municipal bonds are exempt |

| Corporate Bonds | Interest taxed as ordinary | Up to 37% | Can be held in tax-advantaged accounts | High-yield bonds may have higher risk |

| Real Estate Investment Trusts | Dividends are taxed as ordinary income | Up to 37% | IRAs can hold REITs | Some REIT income may be qualified dividends |

| Cryptocurrency | Capital gains tax | 0-20% depending on holding period | Not typically tax-advantaged | Reporting required on sales |

Legal Investment Options

Ensuring your investments comply with legal and regulatory standards is vital for protecting your assets and avoiding costly pitfalls. Traditional investments, such as stocks, bonds, mutual funds, and ETFs, are regulated by authorities like the Securities and Exchange Commission (SEC) and financial industry bodies, providing a high degree of oversight and investor protection.

Government securities are among the safest legal investments, backed by national treasuries and strict regulations. Alternative investments such as peer-to-peer lending and cryptocurrencies require more caution, as regulatory frameworks vary by country and evolve rapidly. Choosing platforms that are licensed and transparent reduces fraud risk and offers peace of mind.

Suitable Strategies for Different Investment Options

Adapting your investment strategy based on your personal goals, risk tolerance, and market conditions is essential to maximize returns and minimize losses. In 2025, tailored approaches can help investors at every stage of life find the best fit.

Investment Strategies for Retirees in 2025

Retirees typically prioritize capital preservation and steady income. Low-risk options like government bonds, dividend-paying stocks, and stable value funds can provide a reliable cash flow. Diversification and tax-efficient accounts such as IRAs or 401(k)s help protect assets against inflation and market downturns.

Sector-specific Investment Opportunities for 2025

Certain sectors, like technology, green energy, and healthcare, show strong growth potential this year. Investing in sector-focused ETFs or stocks can capture this momentum. However, sector investments can be volatile, so it is advisable to balance them with defensive sectors like utilities and consumer staples.

Global vs. Local Investment Options

Diversifying geographically spreads risk and opens exposure to fast-growing markets. Emerging markets in Asia and Latin America offer growth, while developed markets provide stability. Local investments may be easier to monitor and understand but could lack diversification benefits.

Best Investment Options for Beginners

Beginners should focus on low-cost, diversified funds such as index ETFs and target-date funds. Starting with smaller amounts and gradually increasing exposure allows learning with controlled risk. Robo-advisors can simplify portfolio management and provide automated rebalancing.

Investment Options for Different Income Levels

Higher-income investors can explore alternative investments like private equity, real estate, and venture capital, which often require larger minimums but offer high returns. Moderate-income investors benefit from balanced portfolios with stocks and bonds, while low-income investors should prioritize liquidity and low-cost funds.

Pick Perfect Investment Options And Get Your Dream Future

Navigating the investment landscape of 2025 means balancing risk, growth, and personal goals. Whether you’re a beginner just starting out or a seasoned investor refining your strategy, understanding the diverse investment options is key to building lasting wealth.

Remember, no single investment fits everyone. Tailor your choices to your timeline, risk comfort, and financial objectives. Stay informed about market trends, tax implications, and legal requirements to keep your portfolio healthy and resilient.

With careful planning and smart decisions, you can confidently grow and protect your assets in the years ahead. Now is the perfect time to take charge of your financial journey and make 2025 your most prosperous year yet.

Frequently Asked Questions

Beginners should focus on low-cost, diversified investments, such as index funds, ETFs, and target-date funds. These options provide broad market exposure with lower risk and require less hands-on management.

Balancing risk involves diversifying across asset types, combining stocks, bonds, and cash equivalents, and adjusting allocations based on your time horizon and risk tolerance.

High-yield savings accounts offer safety and liquidity with modest interest rates. They are ideal for emergency funds but may not keep up with long-term inflation.

Inflation erodes purchasing power, so investments like Treasury Inflation-Protected Securities (TIPS), stocks, and real estate often serve as hedges against rising prices.

Alternative investments can diversify your portfolio, but they also come with higher risk and volatility. Allocate only a small portion of your portfolio if you have a high risk tolerance and are familiar with these markets.